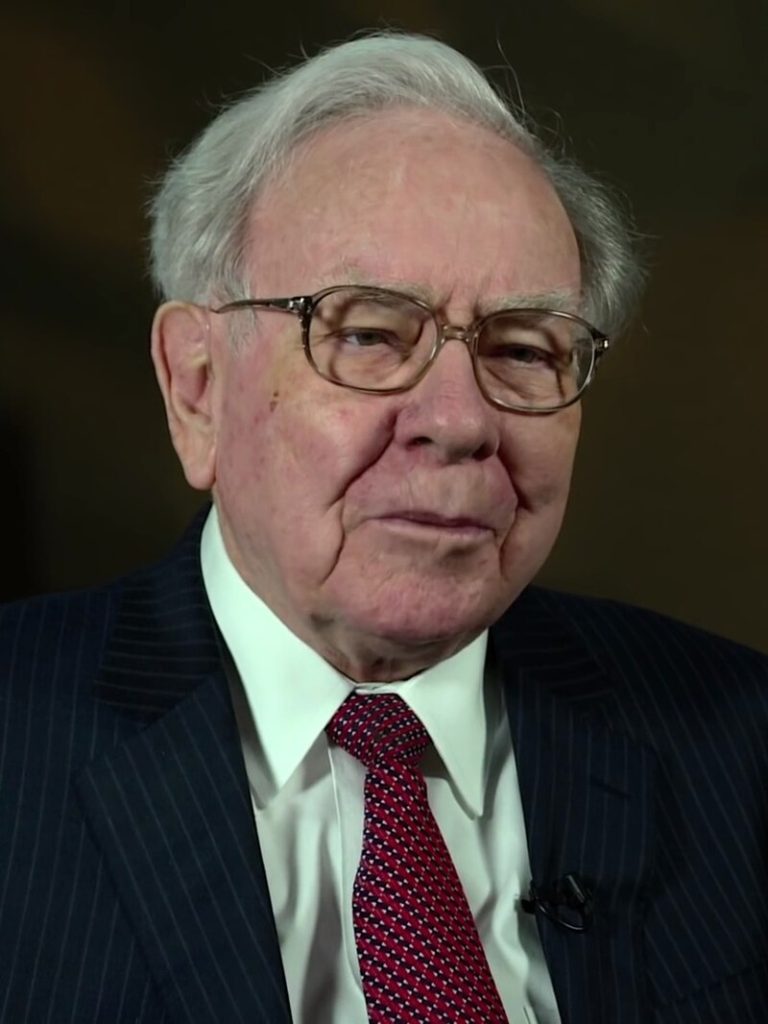

One of those rare moments in corporate history when an iconic leader stepped back-not with fanfare, but with quiet confidence in the future-occurred when Warren Buffett decided to “go quiet” after six decades at the helm of Berkshire Hathaway. Buffett, 95, will no longer write the annual shareholder letter-a fixture since 1965-but he will continue his Thanksgiving message and ramp up his philanthropy, pledging the remaining $149 billion of Berkshire stock he holds to family foundations.

1. A Measured Farewell

There was no victory lap in Buffett’s announcement. In deference to his colleagues and shareholders, he underlined that his stepping down from the CEO role is not a retreat from Berkshire’s mission. “Don’t beat yourself up over past mistakes – learn at least a little from them and move on. It is never too late to improve. Get the right heroes and copy them,” he wrote in his final letter. His reflections balanced humility with optimism, reminding investors that progress, not perfection, defines enduring success.

2. The Philanthropic Pivot

The acceleration of Buffett’s giving is intentional. By converting 1,800 Class A shares-valued at $1.35 billion-into B shares and giving them to four family foundations, he wants to make sure his estate is dispersed while his children, who are 67 to 72 years old, are still the trustees. “To improve the probability that they will dispose of what will essentially be my entire estate before alternate trustees take over, I need to accelerate the pace of lifetime gifts,” he said. It’s part of a larger trend in how big estates do philanthropy, where the living donors do the giving to have greater impact sooner rather than later.

3. Greg Abel’s Rise

His successor, Greg Abel, has been vice chairman overseeing non-insurance operations since 2018 and was publicly named heir apparent in 2021. Under Abel, Berkshire will be much more cautious, with a management style that is hands-on, forged in the operational excellence of his previous life at Berkshire Hathaway Energy. He is likely to preserve the company’s core philosophy-buying well-run, cash-generative companies at reasonable prices-while putting his operational rigor to work. “It’s absolutely critical to our long-term success,” Abel has said of maintaining strong cash flows across subsidiaries.

4. Maintaining a Distinct Corporate Culture

That degree of decentralization-“delegation just short of abdication,” as Charlie Munger has called it-is highly unusual for a conglomerate. With only 24 people at headquarters running a $1 trillion enterprise, decision-making authority resides with the subsidiaries’ managers. The degree of autonomy has attracted singular talent and fostered an owner-operator mentality that Buffett has described as an “economic moat” made of culture. Abel will have his work cut out for him to keep Berkshire coherent as it expands without falling prey to the inevitable forces of cultural dilution inherent in scale.

5. The Patience Premium

Patience and discipline are Buffett’s central legacy in investing. He has mostly resisted the chase for fads; he has held on to quality businesses for decades. As he once said, “Our favourite holding period is forever.” Such a philosophy enabled Berkshire to compound value at approximately 19.8% annually since 1965-more than double that of the S&P 500-because of its philosophy of buying only within a clear circle of competence and at a margin of safety. Abel has signaled he will continue this approach, weighing valuations against long-term prospects before deploying capital.

6. The Cash Question

Berkshire’s hoard of $348 billion in cash is at once a strategic asset and a lightning rod for investor debate. Buffett has justified the pile as a safety net, saying, “Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities.” Abel echoes the sentiment, arguing liquidity gives Berkshire the ability to act decisively when markets are down without relying on outsiders. His willingness to wait for the right pitch is a mirror of Buffett’s own, a reinforcement of the company’s patient capital ethos.

7. Woodstock for Capitalists

What started as a modest, yearly gathering for Berkshire has swelled to as many as 40,000 people attending annually. It is referred to as “Woodstock for Capitalists,” mixing business updates with a festival-like atmosphere of Dairy Queen tastings and limited-edition merchandise. These events personify Buffett’s blend of capitalism and camaraderie and give Berkshire its singularly unique shareholder culture. Though Abel’s decidedly lower profile may temper the tone, the meeting is expected to continue in its role as a cultural anchor for Berkshire investors.

8. Deconstructing the Buffett Premium

Since Buffett confirmed his retirement timeline, Berkshire shares have fallen 7% while the S&P 500 rose 20%, a shift analysts attribute to the “Buffett premium.” This intangible value, one rooted in Buffett’s reputation, cannot be replicated overnight. It would fall on Abel to win over investors with performance, open communications, and adherence to Berkshire’s precepts and slowly supplant personality-driven confidence with results-driven credibility.

It’s not an ending but a transition that mixes philanthropic urgency with faith in a successor. For shareholders, the message is clear: Berkshire’s culture, strategy, and values are built to outlast any single leader. The Oracle of Omaha may be going quiet, but the principles he championed-patience, discipline, and integrity-remain the loudest voice in the room.