Big paydays never ensured long term security in entertainment. To others, the money vanished in contracts that they had lost control over, tax issues which had been quietly accruing over the years, health issues that had disrupted the decision-making process, and expenditure which remained active even as the performance reduced.

The most emotional fact in most of these stories is that the reasons can be so normal: an accountant who had more access than he needed, a divorce settlement that turned everything upside down, or even a lawsuit that resulted in years of bills. The outcomes, however, were not commonplace at all; they were bankruptcies, foreclosures, stolen royalties, and last years of struggle to make the both ends meet.

1. Judy Garland

Garland was one of the most bankable personalities in classic Hollywood but the money did not always remain with her. In addition to the external battle against addiction and inner turmoil, her financial situation was undermined by the deals of career times that did not match her valuation and expenses on fresh life. One of her end-of-life finances mentioned that she was only left with $40,000 when she passed on at the age of 47, after selling property that was way below the estimated price. Her personality became forever; her position never.

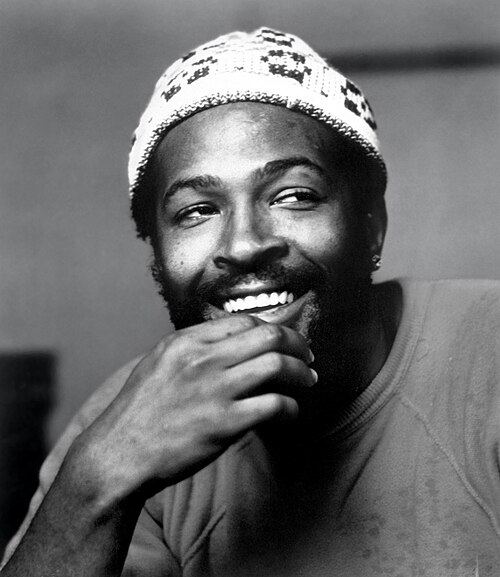

2. Marvin Gaye

The catalog of Gaye became a cultural legacy, and his money was stretched by divorce payments and tax problems that only grew. In the 1970s, he declared himself bankrupt, and thereafter, he had a huge debt related to taxes and back alimony. The other detailed breakdown explained how IRS attempted to collect 1 million dollars in unpaid taxes and other obligations added to 1.9 million total debt at the time of his death. The travesty of lasting hits and personal urgent bills never really calmed down.

3. Billie Holiday

The voice of Holiday influenced American music but the income capability was cut short drastically by the legal and licensing limitations. In 1947, she was arrested on a narcotics charge, and she lost her cabaret card, which restricted her employment and her income. She was re-arrested when admitted in the hospital and her accounts were frozen. She died at the age of 44 leaving 70 cents in the bank a sum which has been and still is recited with variations on her last days, the 70 cents that has remained symbolic of the difference between artistic heritage and personal affluence.

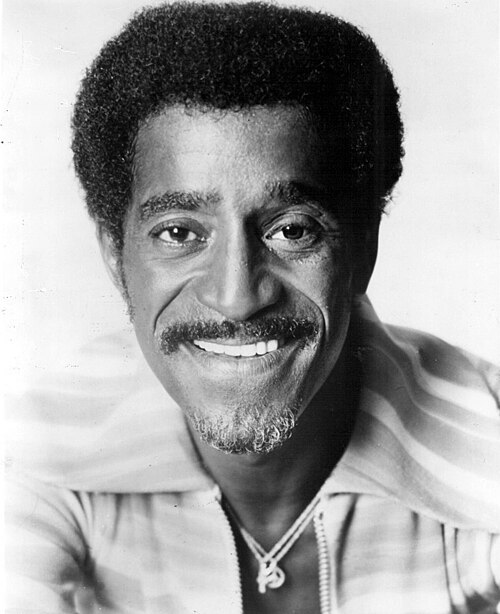

4. Sammy Davis Jr.

At his heyday, Davis made colossal wages, yet gambling, expenditure and most notably tax debt created a long shade. Although his property remained valuable it was less than what was due. His debts were later added up as an accounting of his debts in which he owed 5.2 million dollars in taxes which increased with penalties and interest to 7 million dollars, which drove him to conduct auctions and benefit activities to fill the loss. The stage was kept a working place long into sickness since the creditors do not experience retirement.

5. Mickey Rooney

Rooney performed in vaudeville, studio films and television through her career, though the years did not help in this regard. Several marriages and divorces contributed to it and so did a late in life phase when he claimed he was being manipulated and drained out of money by some relatives. He subsequently delivered a speech on elder financial abuse, then making personal misery a warning. At the time of his death, an estate of tens of thousands was being reported, although he had worked all his life earning a best-paid name.

6. Gary Coleman

Coleman is a child star who became rich and spent the adult life trying to gain control over what was supposed to be preserved. He filed a suit due to stolen funds but legal cases and health expenditures followed as well as a constrained adult work continued to strain his purse. In 1999, he declared bankruptcy and thereafter he was employed in the non-entertainment sector. The tale has become a brevity of how fame can reach an individual before they will have any authority to establish limitations on it.

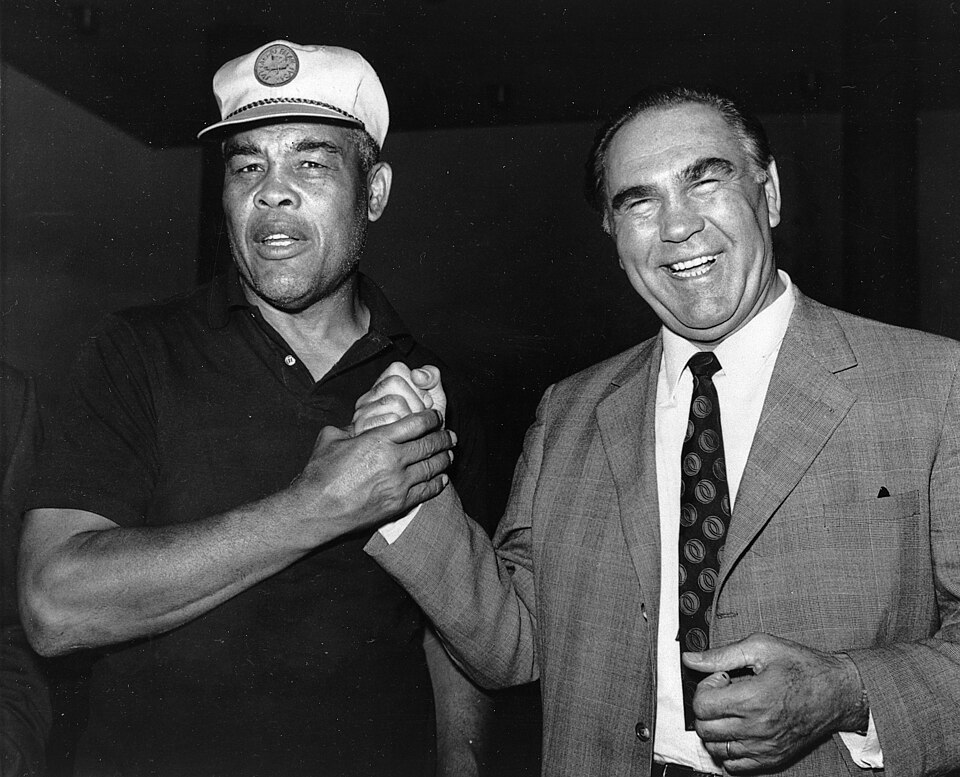

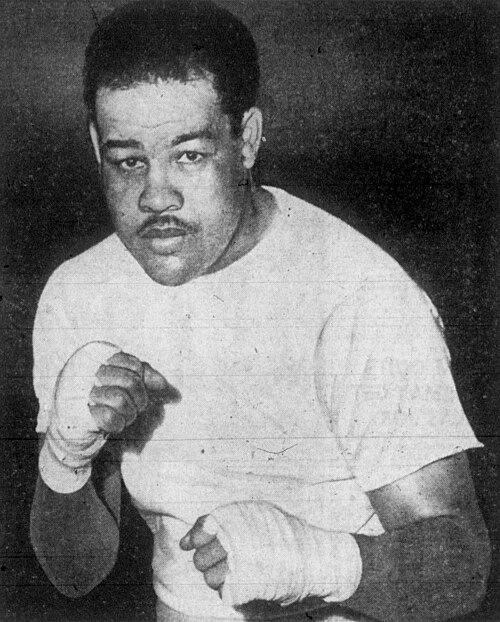

7. Joe Louis

Louis made millions being a heavyweight champion, yet taxes and philanthropy became an issue that would haunt him all his life. The Government took advantage to make him spend a lot of money donating money during the event of World War II, only to realize that even charity money could attract the tax payment. An instance report was that the tax bill increased to over 1 million dollars including penalties compelling him to enter a series of comebacks and other labor to survive. Being a public hero did not mean being financially safeguarded privately.

8. Bela Lugosi

Lugosi was identified with Dracula, but it was the role that brought him fame that limited his prospects. When his size shrank and his health problems were coupled with the addiction, he had to rely on the small-scale projects and other people. One of his numbers continues to circulate: when he passed away, he had left $1,900 in the bank, which, ever since that time, has become inseparable in people’s minds with his name as a warning Hollywood role model.

9. Dorothy Dandridge

Dandridge is one who broke barriers on screen yet her funds were ruined because of bad financial management and business investments that failed to recuperate. This was not only professional pressure, but structural, influenced by a lack of negotiating power and lack of roles in her time. By the early sixties she was in bankruptcy level instability and she passed away young and with a small estate. Her account frequently falls upon the most cruel ears since it combines historical success with so shaky a backdrop.

10. Toni Braxton

Braxton had financial difficulties that were not just related to expenditure but also the minimal amounts she retained out of her own success. One of her most repeated bits of her label deals was that she was making 35 cents per album when albums would be sold in large quantities, which helped lead to a bankruptcy filing during the period of the greatest success. Subsequently health problems and canceled employment aggravated the stress and another filing was made in 2010. Her example is a lesson that the idea of success may have absolutely different appearances on paper and on a bank balance.

11. Sharon Stone

The health was associated with the financial shock: after Stone had a stroke in 2001, she said she went back to her accounts and found her savings empty. She narrated to Vanity Fair that when she returned to her bank account, the money had disappeared. I had no cash at all, which is one of the statements that summed the speed at which vulnerability may turn into financial exposure. The episode has also demonstrated how recovery is not only physical; it may include reestablishing trust, control and fundamental infrastructure.

12. Michael Jackson

Jackson’s earning power was unmatched, yet his spending, loans, and legal costs created a debt load that followed him to the end of his life. Several summaries of his finances cited a forensic accountant’s estimate that he owed $400 million to $500 million at death, with major assets used as collateral and expenses continuing to mount. Afterward, the estate’s management shifted the picture dramatically, showing how different financial outcomes can look under new stewardship even when the person at the center is no longer there.

Across these stories, the repeating pattern is not one specific mistake; it is the combination of high income with unstable structures contracts, access, health, and oversight. The most consistent takeaway is that celebrity wealth often depends on systems that can fail quietly until the numbers become impossible to ignore.

For audiences who grew up admiring these performers, the financial details can feel almost secondary to the work they left behind. Still, the record of lost fortunes offers a clear portrait of how fame can magnify risk as much as it amplifies reward.