Is the American dream of homeownership by age 30 officially dead? For Generation Z, the response is rapidly becoming a resounding “yes” and that’s redefining the playbook of the US housing market. Coming of age between 1997 and 2012, this generation is entering adulthood in one of the most costly housing periods in recent history with mortgage rates still over 6% and housing prices significantly outstripping wage increases. The result a generational pivot toward long-term renting, smaller living spaces, and unconventional paths to ownership.

1. Homeownership Rates Stalling for Gen Z

Last year, 26.1% of Gen Zers owned their homes virtually unchanged from 2023’s 26.3%, according to Redfin. Among the oldest members of Gen Z, only 33% have achieved homeownership, compared to roughly 40% of their parents at the same age. This lag reflects trends among millennials, too, who experienced delayed purchasing timelines from affordability issues. Chen Zhao, head of economic research for Redfin, observes, “Housing affordability is likely making some young adults delay or reconsider family formation.”

2. Renting as a Way of Life, Not a Temporary Measure

Gen Z accounted for 47% of recent renters in the market in 2024, Multifamily Executive reports. By 2030, ARBOR forecasts they will be America’s biggest renter population. In a survey conducted by Entrata, it was discovered that 59% of Gen Z renters view renting as a long-term option, with 83% responding that it enables them to save for life experiences rather than material goods. Virginia Love of Entrata says, “They don’t feel like they need to adhere to the entire ‘college, marriage, baby, house, bigger house’ timeline they can do whatever life they want.”

3. Affordability Crisis Delaying Family Formation

The affordability pinch is reconfiguring family sizes and postponing family milestones. Realtor.com’s Jake Krimmel points out that the national median list price has risen 36% since 2019, as the cost per square foot has increased over 51%. Starter homes are in short supply, and big family homes come with prohibitive premiums. This “misallocation of housing,” in which empty nesters maintain oversized homes, clogs the pipe for younger buyers.

4. Compact Houses and Multigenerational Family Living

Construction companies are answering affordability pressures by trimming the size of houses new homes have decreased by 10 square feet every year during the last five years, data from Cotality reveals. Molly Boesel, chief economist at Cotality, anticipates increased multigenerational houses and co-ownership-friendly designs. Bank of America says that about a quarter of Gen Z homebuyers bought with their parents, and 22% bought with siblings up dramatically compared with past years.

5. The Historical Transition from the Baby Boom Model

Post-WWII housing trends wed early, buy a starter home, raise kids are rapidly disappearing. As Rutgers’ James Hughes observes, “What we have a lot of today double income, no kids.” The national birth rate has fallen significantly below replacement level, and postponed household formation is amplifying the softness in housing demand. Population Reference Bureau’s Diana Elliott cautions that the chances for another baby boom are very, very low.

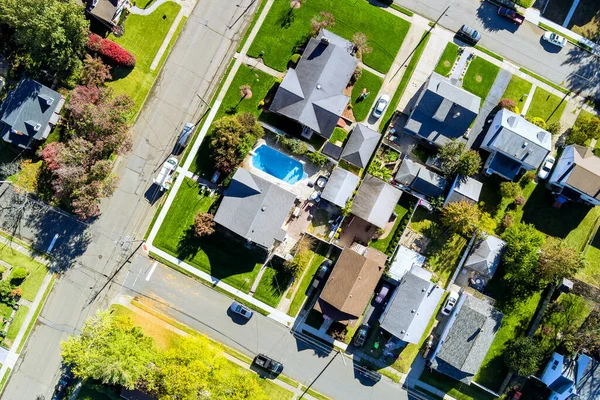

6. Housing Supply Gap and Regional Disparities

Despite a surge in new-home completions reaching a 20-year high, the U.S. still faces a 3.8 million-unit housing shortage. At the current pace, it would take 7.5 years to close the gap. The South is on track to resolve its shortage in three years, while the Midwest could take 41 years and the Northeast shows no improvement. These inequalities are exacerbated by zoning limitations and local cost variations John Ho of Landsea Homes explains that starting homes in California cost $800,000–$900,000 on average, versus $400,000 elsewhere.

7. Builders Pivoting to Higher Density and Flexibility

Builders are turning to smaller, more compact housing forms condos, townhouses, and prefab construction to keep up with changing demand. Attached single-family building expanded in 2024 at twice the rate of stand-alone homes. Lot values and square footage are down, and houses are more likely to include separate entries and rentable areas to fit in roommates or extended families.

8. Policy Reforms as a Path Forward

Experts say zoning reform is needed to liberate more supply. Measures involve permitting “middle housing” forms, easing parking requirements, and simplifying permitting. Zillow public opinion survey data indicate expanding support among the public for greater density to relieve affordability. In the absence of reform, supply-demand imbalance will continue to constrain homeownership for many young Americans.

As Gen Z redefines adulthood in its own language, the housing market is being compelled to change. The trend toward renting, smaller houses, and ownership-sharing models is more than a fleeting reaction to sky-high prices it’s a structural shift that has the potential to redefine U.S. housing demand for decades.