But can a single corporate deal really change the future of Hollywood storytelling? Netflix’s $72 billion acquisition of Warner Bros.’ film and streaming assets is more than just a headline it represents a seismic shift in the entertainment industry balance of power, extending from how fans engage with movies to global market dynamics.

1. The Largest Consolidation in Modern Hollywood

The deal, unanimously approved by both companies’ boards, marks one of the largest entertainment mergers ever. Including debt, the value of the transaction jumps to more than $82 billion. Netflix will add Warner Bros.’ century-spanning library, HBO and HBO Max, and flagship franchises like Harry Potter, Game of Thrones, DC superheroes, The Lord of the Rings, and Friends. “Warner Bros have defined the last century of entertainment, and together we can define the next one,” said Netflix co-CEO Ted Sarandos.

2. A New Streaming Superpower

Already the world’s largest subscription streaming service, Netflix will absorb HBO’s 128 million subscribers into its more than 300 million-strong base, creating a platform that Mike Proulx of Forrester says could be “arguably untouchable.” This merger marries prestige television like Succession and The Sopranos with Netflix originals such as Stranger Things, giving a breadth of content unprecedented on one platform. Analysts note the combined market share in U.S. streaming could hover at 30–40%, a level that triggers antitrust scrutiny.

3. Strategic Fit and Shareholder Upside

The board at Warner Bros. Discovery preferred Netflix’s cash-and-stock offer over a higher all-cash bid from Paramount, citing the long-term upside of holding Netflix shares. The deal promises $2-$3 billion in annual savings from eliminating overlaps in technology and support functions, with reinvestment in new programming. Shareholders will also retain equity in Discovery Global, the spun-off cable networks division.

4. The Future of Theatrical Distribution

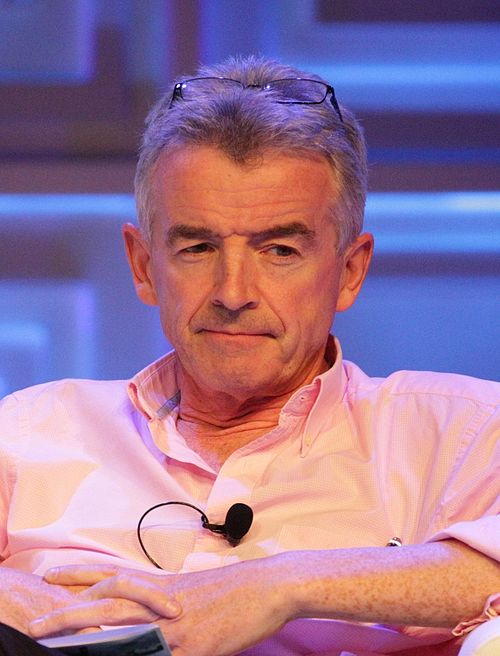

Netflix has pledged to keep Warner Bros. movies in the theatres, an apparent olive branch to Hollywood, but some have remained unconvinced following an earlier Sarandos pronouncement that movie-going was “outdated.” Cinema United CEO Michael O’Leary said if Netflix shifts more titles to streaming-first models, “theatres will close, communities will suffer, jobs will be lost.” The DC Universe, Dune and Harry Potter films historically box office draws will test Netflix’s commitment to theatrical windows.

5. Regulatory and Political Hurdles

The review will be led by the U.S. Department of Justice’s Antitrust Division, with possible contributions from the Federal Trade Commission, state attorneys general, and the European Commission. Concerns include lessened competition, pricing power for monopolists, and damage to content diversity. Sen. Elizabeth Warren referred to the deal as “an anti-monopoly nightmare,” while Sen. Mike Lee said it “should send alarms to antitrust enforcers around the world.” President Donald Trump acknowledged “they have a very big market share” and promised to consult economists before weighing in.

6. Impact on Creators and Workers

The Hollywood unions, which include the Writers Guild of America, have opposed the merger vehemently, saying it would “eliminate jobs, push down wages, worsen conditions for all entertainment workers, raise prices for consumers, and reduce the volume and diversity of content.” Roy Price, chief executive of International Art Machine, said the danger is “not annihilation but centralization,” with fewer buyers for creative work and narrower opportunities for talent.

7. Historical context of Hollywood mergers

From Disney’s buying Fox to Amazon buying MGM, consolidation has continuously reformed the shape of the industry. However, the Netflix-Warner Bros. deal is unique in size and cultural consequence, tying together the number one and number three streaming platforms. Past mergers have more often than not resulted in layoffs, cultural clashes, and shifts in production priorities-all issues Warner Bros. employees might encounter again after living through changes under AOL, AT&T, and Discovery ownership.

8. Consumer Choice and Pricing

It is not clear how the deal will affect subscription prices. One analyst said Netflix, with its leading position, can raise prices, but it may lower costs for consumers if HBO Max is absorbed into Netflix. Co-CEO Greg Peters called the HBO brand “very powerful” and teased future bundling plans to drive retention and engagement.

9. Competitive Ripples Across the Industry

Disney, Amazon, Apple, and Paramount are rivals confronted with a competitor that has unparalleled scale, insight into subscriber data, and bargaining clout. Control over high-value IP can provide Netflix with the ability to unilaterally determine licensing terms and compress theatrical windows as a way of forcing competitors’ subscriber retention and content acquisition costs upward. Paramount, having lost the bidding war, can still mount regulatory challenges or even consider a hostile takeover bid.

10. Global Implications and AI Potential

European regulators might also demand conditions, like mandatory licensing, to maintain content diversity. Analysts also see a tech dimension: the deal could provide Netflix with premium content to train next-generation AI models that will further improve personalization and engagement. As Janus Henderson’s Divyaunsh Divatia noted, Netflix is “levering up on premium entertainment at a time when competition on engagement from short form video is expected to intensify.”

The Netflix-Warner Bros. merger would mark a defining moment in Hollywood’s evolution, a moment that melds legacy storytelling with streaming-era scale, while firing up debates over competition, creativity, and what the cultural future of entertainment looks like.