“Americans aged 65 and older accounted for 22% of spending in 2022,” says the US Labor Department. But step into some high-street mainstays, and that generational divide is starkly-almost cinematically-in full view. To baby boomers, these shops are comforting oases-familiar haunts where service, routine, and touching and feeling still count. To Gen Z, they’re remnants of a slower retail era, replaced by curated edits, ethical sourcing, and light-speed checkouts.

This divide is not just about taste-it is about how values, technology, and time shape every purchase. Boomers are drawn to brands that have earned their trust over decades, while younger shoppers chase novelty, transparency, and digital convenience. The result? Some chains remain magnets for one group and less popular spots for the other, revealing where high-street retail is heading next.

Here are ten of the most striking examples and what they say about the future of shopping.

1. Macy’s vs. JCPenney: Ritual vs. Minimalism

To boomers, Macy’s and JCPenney still hold the charm of a day out at perfume counters, seasonal sales, and service desks that know your name. Store cards add another reason to return. But to Gen Z, all it sees is cluttered floors and too many racks; it wants clean layouts and tight brand edits. Gen Z favors the clarity and speed of direct-to-consumer and prefers seamless omnichannel shopping.

2. Sears: Legacy Trust Meets Digital Speed

Sears once equated to first appliances, first tools, and a first credit line, with catalogues as household fixtures. Boomers still trust its long-standing reputation. To younger buyers, dated signage and sparse stores signal obsolescence. They’d rather order a washer online and have it delivered the same day-a reflection of the hybrid retail shift in which digitally influenced purchases surpass 70% in many categories.

3. Kay Jewelers and Zales: Milestones versus Meaning

Older couples covet in-person sparkle, warranties, and milestone rituals. Generation Z redefines romance with lab-grown diamonds, vintage finds, and indie designers. As designer Cece Fein Hughes told Vogue Business, “Commissioning a custom symbolic piece is a bit like choosing a tattoo: it’s deeply personal.” This chimes with the desire for authenticity and ethical sourcing across Gen Z.

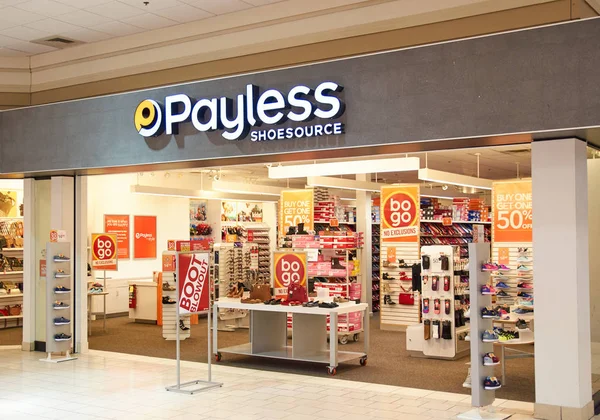

4. Payless ShoeSource: Function vs. Identity

Payless once clothed entire families in inexpensive, practical shoes. Boomers still appreciate direct pricing and simple sizing. To Generation Z, sneaker culture is status-oriented, about ‘drops,’ ‘collabs,’ and sustainability. A wall of lookalikes sends them to resale apps or brands using recycled materials-a reflection of the broader shift toward values-driven purchases.

5. Pier 1 Imports: Eclectic Past, Outpaced Present

Pier 1’s mosaic lamps and bamboo chairs once lent suburban homes a bit of that exotic flair. Boomers still favor gifting its gifty, eclectic decor. Generation Z favors thrifted or upcycled pieces, hauled off peer-to-peer platforms. The decline of Pier 1 is a case study in the perils of misjudging competition: management fixated on Pottery Barn, while 50% of customers actually cross-shopped at either Target or HomeGoods, eroding perceived value.

6. Bed Bath & Beyond: Paradox of Choice versus Curated Calm

They love the coupons, the registries, and the rows upon rows of aisles. Meanwhile, Generation Z looks at overload and maze-like layouts; all they want is narrow ranges from brands that match their palette. They read the reviews, tap to buy, and skip the trip-mirroring Gen Z’s mobile-first shopping habits.

7. Dillard’s and Talbots: Correct Fit versus Fluid Fashion

Whereas Boomers love formal wear and dependable basics, tidy stores, and expected sizing, the reverse is what works for Gen Z-dressing for personal expression, comfort, and gender-fluid options. Stores that signal “correct” will be exclusionary, making younger shoppers gravitate to brands embracing inclusivity and playfulness in design.

8. Hobby Lobby: Aisles to Apps

For Boomers, this translates into long craft-store browses, seasonal projects, and activities with the family. To a Gen Z, creativity lives online: buying from small makers; using digital tools to create; and attending virtual workshops. Values concerns similarly drive them onto independent artists, underscoring a shift away from mass aisles into personalized marketplaces.

9. Staples and Office Depot: Tangible Order vs. Cloud Clarity

Boomer generation gets excited about new stationery and label makers; for them, that’s organization. But for Gen Z, notes, calendars, and storage all live in the cloud. A stack of printer paper amounts to clutter, not progress-the very idea reflects a preference for minimum desk arrangements and digital efficiency.

10. The Loyalty Gap: Trust vs. Conditional Commitment

Where Boomers stay with brands for decades, based on quality and service, the loyalty of Gen Z is pickier: 61% position themselves as “forever customers” for no more than several brands, recent consumer insights show. They are quick to change if values, relevance, or digital experience let them down, making omnichannel integration and authenticity non-negotiable for retailers.

This isn’t a generational divide between old and young; it’s deeper, layered in cultural and technological and values-based shifts. Boomers reward familiarity and service; Gen Z rewards speed, ethics, and curated clarity. And the retailers that will ultimately make it are those who can bridge these worlds: shrinking clutter, embracing sustainability, and putting seamless digital touchpoints on top of tactile service. By doing so, they won’t just survive the split but make it an advantage.