What does it take for a company to bet its future on one person? For Tesla’s shareholders, the answer came in the form of a record-shattering $1 trillion pay package designed to keep Elon Musk at the helm for the next decadea combination of ambition, controversy, and high stakes for the vision of this automaker’s future.

1. A Vote That Signals Unprecedented Confidence

Not counting the 15 percent Musk already owns, more than 75 percent of Tesla’s voting shares supported the deal. The package is performance-based, with Musk receiving an additional 423.7 million shares if Tesla hits a series of ambitious targets. If Tesla were to hit all those targets, its stock could be worth around $1 trillion, or $275 million a day over ten yearsa record no corporation has ever matched.

2. Lofty Targets & Market-Cap Ambitions

That means Tesla’s market capitalization would need to jump from about $1.5 trillion today to $8.5 trillion, up 466% from today and well beyond the value of today’s most valuable company, Nvidia. Other operational targets include delivering 20 million vehicles, producing one million humanoid robots, deploying a million self-driving robotaxis, and $400 billion of core profit.

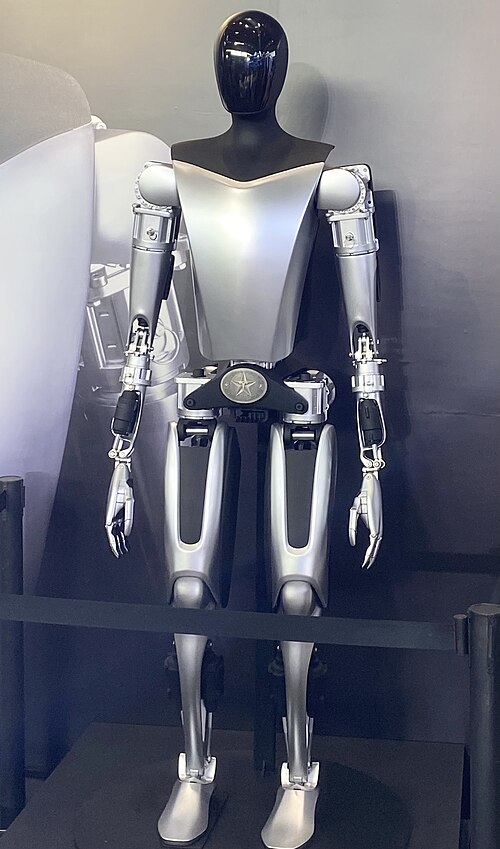

3. Musk’s Vision Beyond Cars

Speaking at length in Austin about Tesla’s Optimus robot, which he described as “the most important product Tesla will make by far”, Musk wants every human on the planet to have a personal AI-powered assistant-think R2D2 or C3PO. He has said they might also replace surgeons, end global poverty and reform the economic order-albeit none having gone on sale yet.

4. The Stakes of Retention

Tesla’s board said the package was needed to retain Musk, a risk exacerbated by his hints of possibly leaving without guarantees of control. “It’s less about compensation and more about the voting influence,” said Denholm, the chair of Tesla’s board. Critics, including Tom Dinapoli, the New York State comptroller, say it equates to “pay for unchecked power.”

5. Historical Background of CEO Compensation

The deal outstrips Musk’s own 2018 package, then valued conservatively at $2.6 billion, and eclipses the median CEO pay in the Equilar 500, which stood at $16.2 million in 2024. That median has risen 31.7% since 2020, but still pales next to Musk’s potential earnings. The package also spotlights the growing CEO-to-employee pay ratio, with the average ratio hitting 213.5:1 last year.

6. Founder-Led Companies and Strategic Impact

Rohan Williamson of Georgetown University says Musk’s case is “largely unique to Tesla,” though such a deal may become more common in founder-led startups. History is replete with examples of founders who, with big equity stakes, bring in outsized growth, though concentrated control raises governance concerns.

7. Legal Shadows from Delaware

The $1 trillion package comes when the $56 billion award from Musk is still pending review before the Delaware Supreme Court, a lower court having already voided it for procedural flaws and board conflicts. Tesla reincorporated in Texas, sidestepping Delaware’s jurisdiction for the new deal. However, legal experts do not expect the earlier award to be reinstated, which underlines the board’s urgency to secure fresh terms.

8. Investor Sentiment and Market Reaction

While large institutional investors such as Norway’s sovereign wealth fund and CalPERS voted against the package, it is Tesla’s unusually large base of retail shareholders that proved decisive. The shares have gained more than 62% in six months despite sales and profit declines earlier in the year. Analysts like Dan Ives at Wedbush see the deal as unlocking “AI-driven valuation” potential in the near term.

9. The Larger Trend: Standardization versus Strategy

A study by Virginia Tech warns that CEO pay is becoming more standardized across industries due to proxy adviser influence and disclosure rules. This can weaken alignment between incentives and company strategy. Tesla’s package breaks from that mold by tailoring rewards to Musk’s particular role and the company’s aggressive growth agenda.

10. Risks and Rewards Ahead

The road to $8.5 trillion of market value is steep and involves more than technological breakthroughs; sustained operational excellence is needed. The question remains whether Musk can balance Tesla’s core EV business with his robotics ambitions. This package ensures he both has the incentive and the influence to go after that vision-whether ultimately a master stroke or gamble, depending on the results through the next decade.