This is a sort of tragedy, occurring somewhere off-center: a name on the marquee, and a checking account that can no longer support it. The masses are exposed to the gowns, the tour busses, the film posters. Lawyers, tax bills, failed deals, and individuals who are perfectly aware of where the money is meant to be can be part of the personal life.

The stories have a formula that is unglamorous in intent income comes in in floods, and then it seeps away in inappropriate deals, addictions, divorces, and mismanagement. The loss in a few instances is not only financial, but also control.

1. Judy Garland

Garland started his career behind the machineries of the studio system where compensation was hardly commensurate with cultural influence. She received a pay of 500 a week during The Wizard of Oz and this, even to this day, might hit a chord considering the film afterlife. Subsequently, there were more than enough punishing schedules, personal relationships that were unstable and dependence making it harder to sustain consistent work. Debt but not prestige defined her finances, at the end, and the disjuncture between her mythology and her actuality grew into something too vast to be overcome.

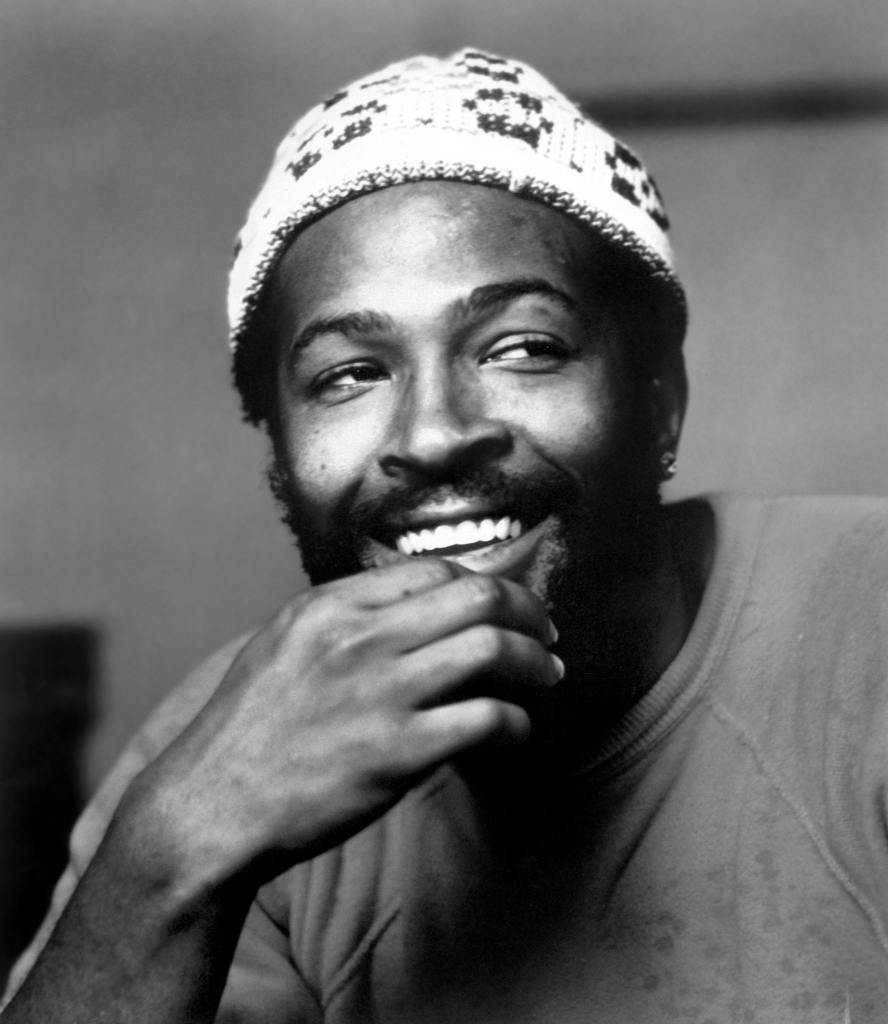

2. Marvin Gaye

The catalog of Gaye turned into a legend, but his finances turned into a battlefield. Divorce, extravagant expenditure and tax evasion emptied out what was meant to be a permanent guarantee. The pressure was so high that he at one point left the U.S. to get away with creditors and IRS. The subsequent resurgence in the career was not able to overcome the instability that had already been established.

3. Bela Lugosi

Dracula by Lugosi created a genre, but typecasting limited him to the point where the paychecks were reduced and where the parts became so thin that there was none left to play. The addiction helped to add to the damage by making professional restriction financial suicide. He left an estate that was estimated to be 1,900, which is the punchline of an article had it not been the property of a man that had contributed to the foundation of Hollywood horror.

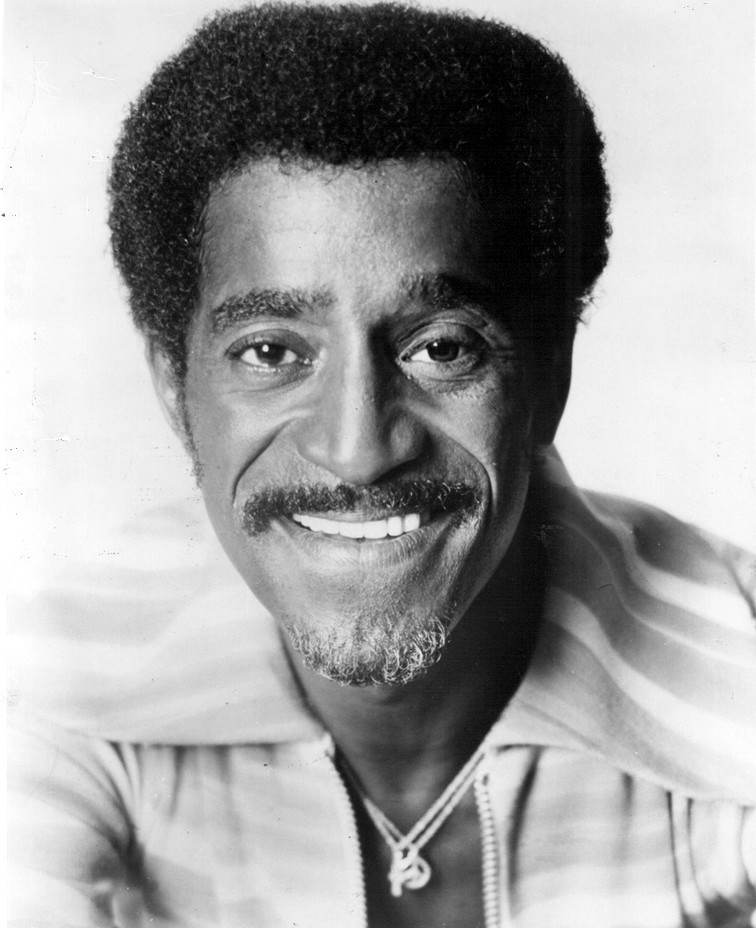

4. Sammy Davis Jr.

Davis made immense incomes in his heyday, sums which betokened permanence. The crumbling was caused by old friends: gambling debts, excessive expenditure and a crippling tax bill. The assets were disposed of, performance was carried on, and financial repair was not a policy, but an emergency pose sustained until the last penny was paid off owed the IRS at 7 million dollars.

5. Dorothy Dandridge

Dandridge became the first African American nominated to the Oscar and earned good weekly wages during her time, yet she lost her sanity through poor management and ill-fated projects. One of the investments was a bad nightclub and debt accrued, and repossessions. She passed away with a reported estate of less than $5,000 a sad conclusion to an actor whose career had a cultural weight way out of proportion to her bank balance.

6. Mickey Rooney

It is not merely a spending or contracts tale but a tale of exploitation in old age as Rooney tells it. He even went to testify in front of the crowd regarding elderly abuse and financial exploitation, and recounted how he was confined in his life by the control of other individuals into making his most fundamental decisions. The result of his decades of labor reported his estate as barely able to cover less than 20,000 dollars, which highlights the fact that vulnerability can come one long after the celebrated status.

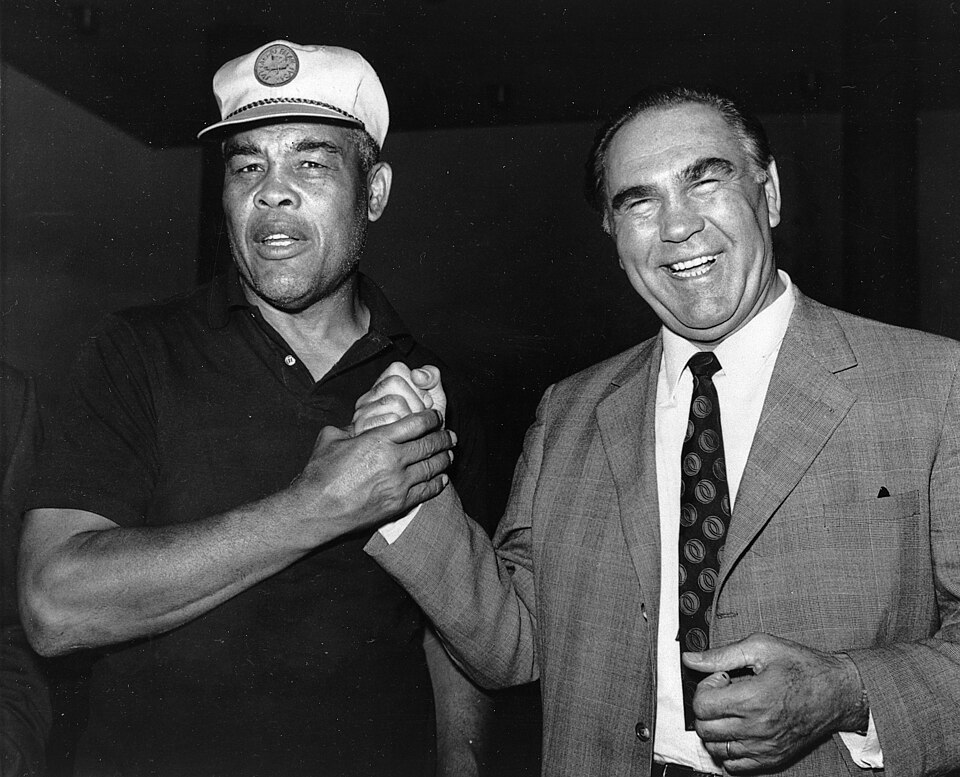

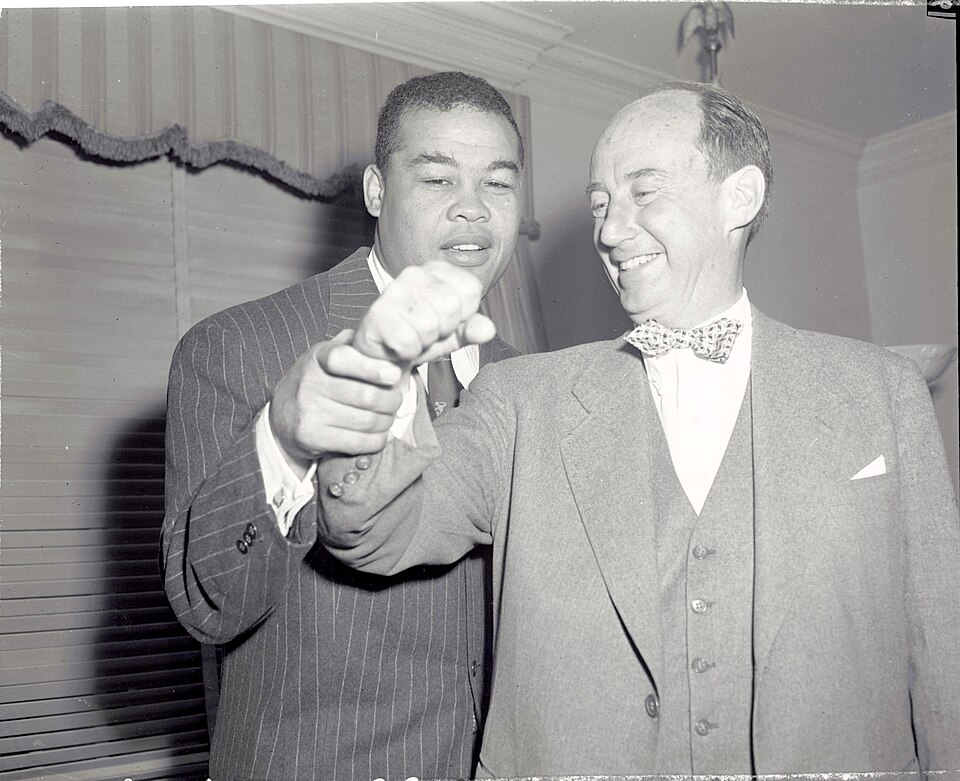

7. Joe Louis

Louis had made millions in the ring, but taxes he failed to pay, and generosity he could not plan out, both exposed him. The disgrace in losing dignity is the most disturbing moment: he eventually became a casino greeter that earned 50 dollars a day. It is a message to the world that no one is immune to the compounding effect of financial neglect despite their high income levels.

8. Billie Holiday

The money earned by Holiday previously projected safety but her life turned out to be a melting pot of exploitation, addiction, and punishment. She demanded her own music, Strange Fruit, which she first sang publicly in 1939 at Cafe Society in Greenwich Village, and her fame led to unremitting criticism. When she died there was hardly any money left, it is said, this artist whose voice added to the culture and whose money was failing down the drain.

9. Gary Coleman

As a child actor Coleman made unbelievable sums of money, which was listed to be 18 million, but the adults surrounding him mismanaged the money. There was the bankruptcy and subsequent employment in a mall as security officer. His tale lies on the border between fame and protecting where the success of a minor can be the goal of an adult.

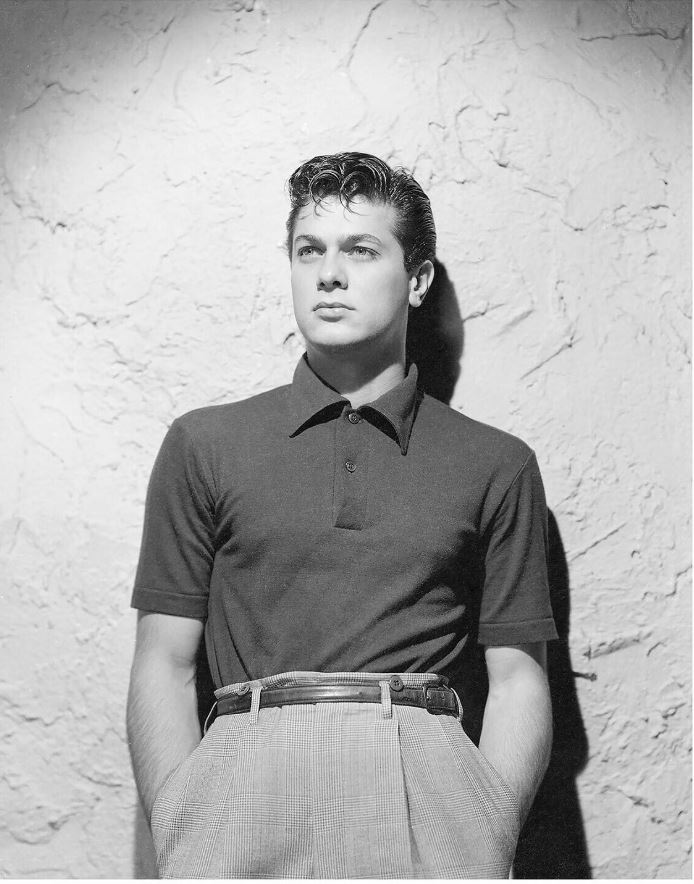

10. Tony Curtis

Curtis earned a lot of money, which was gradually being spent by divorces, gambling, and poor planning. Later in life, he resorted to selling art to settle bills and costs. The reported bequest at his death, of about 60,000 dollars, indicates how speedily a long career may be swept away on the expenditures side and be neglected on the controls side.

11. Janis Joplin

The income of Joplin shot up following fame with reported charges of 20,000 per show. However, speed of success coupled with a hectic lifestyle did not offer much to be saved. Her death at a youthful age and with an estate that was a fraction of the legend that she was depicts how the lack of time can be dangerous to a person as money itself.

12. Judy Holliday

The forces greater than personal spending ruined the career of Holliday. Labor was reduced during the troubled times of blacklisting and graylisting, which redefined the employable and those who had been unobtrusively marginalized. Healthcare invoices came when the prospects went down the drain. Her stated assets less than 10,000 feet sum up the effects of income becoming a variable of access, and access becoming politicized.

Financial disaster is commonly a moralizing story, yet these lives tell more of a lessons about systems: tipped out payment schemes, parasitic relationships, lax laws, and how being famous is a false security net. The losses are hardly over in a single dramatic moment. They come in via paperwork, silence and gradual relinquishment of control.

The best part is not the amount of money made, but the number of people those that made it through to the end without one thing that truly counts security.